It's been more than three months since I re-drew my medium-term view of the stock market.

You'll remember that back in February, just as the world and his wife were beginning to feel good about entering the equity markets again after last summer's crash, I started nudging my reader towards the exit.

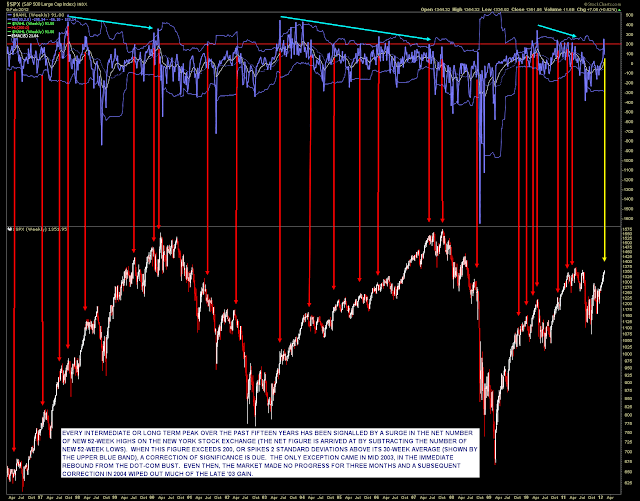

Here's the technical picture I suggested should be filed under 'do not ignore':

A few years ago I came up with this indicator almost by accident, since when it has become one of my most reliable bellwethers. I simply use a standard measure of the breadth of the Nasdaq Composite - its weekly total of net new 52-week highs ('net' as in new highs minus new lows) - and then surround that indicator with volatility bands to show when the total is reaching an extreme relative to its recent range.

Here's what I said on February 10th:

'This is absolutely not a time to be committing new long-term funds to the market, as current risks outweigh rewards.

The S&P500 and correlated stock markets will shortly:

- a) suffer a correction / form a major top

or

- b) move sideways for several weeks or months before beginning another leg higher

Now - it may be that we are in a similar position to late 2010, and we'll pause only briefly here before making another charge. But chasing such a move will be strictly for shorter-term players (and lemmings) as chances are extremely high that any and all gains made will be given back in a sharp downdraft, with little warning.'

Well we got another charge alright, and any lemmings will certainly have been dashed on the rocks after this sharp downdraft. The only remaining question in my mind is whether the top we saw in April was the last stop for this bull market, or merely the last staging post on the way to a final glorious peak later in the year.

I still don't know the answer. That's probably because I'm not smart enough to see it. Bears whom I respect point to head-and-shoulders tops in the S&P500 and Russell 2000 small-cap indexes, poor recent price action, complacency in some sentiment measures and of course, the macro disasters brewing in Europe, China and even, God help us, Japan.

Believe me, I see the same horror show (and have hand-wrung about it many times in these pages as my long-suffering reader well knows). Long term, I do think that the developed economies are cooked, that equity markets will struggle mightily through the rest of this decade and that those few housing market bubbles across the world which are yet to pop are living on borrowed time. So I'm hardly some dewey-eyed optimist: check the sub-title of this blog, which has been sitting up there, disbelieved and unloved, since I set up shop back in 2009.

However there's at least one good reason not to don our bear costumes just yet. Take a look at the flipside of the chart I showed you above.

It turns out that the Net New Highs indicator can be used almost as confidently to pick bottoms as it can be relied upon to pick tops.

Again, we're looking at new 52-week highs minus new 52-week lows (blue line), and the Bollinger Bands surrounding it which measure two standard deviations from a 30-week mean. In a substantial correction, the line drops into negative territory as new lows overwhelm new highs. It may, if the downdraft is powerful enough, tag its lower Bollinger Band. The buy signals (green lines) are the first week thereafter that the line pops back inside the band.

I've split the 16-year time series into three so you can see the signals more easily. Above, the greatest stock market boom in history and its ugly backside, below the Noughties bull and its horrible rear end...

...and finally Bernanke's load of old bull since 2009.

In total, this indicator gave 36 buy signals. It was either at or within two weeks of a tradeable low on 28 occasions.

During a bull market (as defined by a rising 40-week simple moving average), that tradeable low was usually the precursor to a substantial rally. Of those 21 signals, all but 5 resulted in new bull market highs. In a bear market (falling 40-week average) signals tended to produce at worst a pause in the selling, at best a very decent bounce.

It's also worth noting that it is quite common for price to make a lower low after the buy signal, even if the indicator itself does not. This is a classic divergance revealing that, although the average itself continues to decline, the number of stocks within it hitting new lows is waning. That is a sure sign of an impending turn.

But the number of net new highs is by no means the only bullish indicator out there. Other positive measures include the trusty CBOE Equity Put/Call Ratio, which recently dropped firmly into buy territory. This gauge of investor sentiment is one of the few it has paid an investor never to ignore.

Despite my misgivings then, I'm cautiously optimistic that a rally will take shape in the next week or two, even if it fails to take out the highs hit in April. Probabilities suggest that the chances of us heading meaningfully lower directly from here are not high compared to the likelihood of a bounce, or indeed a substantial rally. This means that, at these levels, risk/reward favours those traders willing to take a constructive but tactical view.

Phasing in on any spikes to new lows, or adding on any unexpected good news which provokes strong buying is a strategy which historically would have proved profitable in such conditions.

Assuming the turnaround comes, I'll then be watching various indicators of breadth, volume, sentiment and momentum to see if this thing really is on its last legs. Any positions I take I'll post and update via Twitter.

So while the signs are certainly not good long term, for now I'm willing to give this wheezing market the benefit of the doubt. It may be badly wounded, but don't be surprised to see one last gore-fest for Bernanke's old bull.

Well we got another charge alright, and any lemmings will certainly have been dashed on the rocks after this sharp downdraft. The only remaining question in my mind is whether the top we saw in April was the last stop for this bull market, or merely the last staging post on the way to a final glorious peak later in the year.

I still don't know the answer. That's probably because I'm not smart enough to see it. Bears whom I respect point to head-and-shoulders tops in the S&P500 and Russell 2000 small-cap indexes, poor recent price action, complacency in some sentiment measures and of course, the macro disasters brewing in Europe, China and even, God help us, Japan.

Believe me, I see the same horror show (and have hand-wrung about it many times in these pages as my long-suffering reader well knows). Long term, I do think that the developed economies are cooked, that equity markets will struggle mightily through the rest of this decade and that those few housing market bubbles across the world which are yet to pop are living on borrowed time. So I'm hardly some dewey-eyed optimist: check the sub-title of this blog, which has been sitting up there, disbelieved and unloved, since I set up shop back in 2009.

However there's at least one good reason not to don our bear costumes just yet. Take a look at the flipside of the chart I showed you above.

Nasdaq Net New Highs, Weekly, 1996-2002

|

Please click to enlarge |

Again, we're looking at new 52-week highs minus new 52-week lows (blue line), and the Bollinger Bands surrounding it which measure two standard deviations from a 30-week mean. In a substantial correction, the line drops into negative territory as new lows overwhelm new highs. It may, if the downdraft is powerful enough, tag its lower Bollinger Band. The buy signals (green lines) are the first week thereafter that the line pops back inside the band.

I've split the 16-year time series into three so you can see the signals more easily. Above, the greatest stock market boom in history and its ugly backside, below the Noughties bull and its horrible rear end...

Nasdaq Net New Highs, Weekly, 2003-2009

|

Please click to enlarge |

...and finally Bernanke's load of old bull since 2009.

Nasdaq Net New Highs, Weekly, 2009-2012

|

Please click to enlarge |

In total, this indicator gave 36 buy signals. It was either at or within two weeks of a tradeable low on 28 occasions.

During a bull market (as defined by a rising 40-week simple moving average), that tradeable low was usually the precursor to a substantial rally. Of those 21 signals, all but 5 resulted in new bull market highs. In a bear market (falling 40-week average) signals tended to produce at worst a pause in the selling, at best a very decent bounce.

Currently - despite the pervasive air of doom and gloom - we are technically still in a bull market.

It's also worth noting that it is quite common for price to make a lower low after the buy signal, even if the indicator itself does not. This is a classic divergance revealing that, although the average itself continues to decline, the number of stocks within it hitting new lows is waning. That is a sure sign of an impending turn.

But the number of net new highs is by no means the only bullish indicator out there. Other positive measures include the trusty CBOE Equity Put/Call Ratio, which recently dropped firmly into buy territory. This gauge of investor sentiment is one of the few it has paid an investor never to ignore.

|

CBOE Equity Put/Call ratio, with volatility bands. Green lines = buy signals, similar in principle to Net New Highs indicator. |

Despite my misgivings then, I'm cautiously optimistic that a rally will take shape in the next week or two, even if it fails to take out the highs hit in April. Probabilities suggest that the chances of us heading meaningfully lower directly from here are not high compared to the likelihood of a bounce, or indeed a substantial rally. This means that, at these levels, risk/reward favours those traders willing to take a constructive but tactical view.

Phasing in on any spikes to new lows, or adding on any unexpected good news which provokes strong buying is a strategy which historically would have proved profitable in such conditions.

Assuming the turnaround comes, I'll then be watching various indicators of breadth, volume, sentiment and momentum to see if this thing really is on its last legs. Any positions I take I'll post and update via Twitter.

So while the signs are certainly not good long term, for now I'm willing to give this wheezing market the benefit of the doubt. It may be badly wounded, but don't be surprised to see one last gore-fest for Bernanke's old bull.